Harvey’s

Harvey’s

Economic Impact on

Economic Impact on

Corpus Christi MSA

Corpus Christi MSA

October 11, 2017

Economic Recovery Briefing

Economic Recovery Briefing

§ Harvey’s overall damage costs (preliminary)

§ Immediate impact on the metro area

§ Property losses in affected communities

§ Analysis of recovery efforts with model simulations

§ Implications for the community and the region

§ Lesson from recent events

Overview

2

Groundwork and conceptual framework for today’s program …

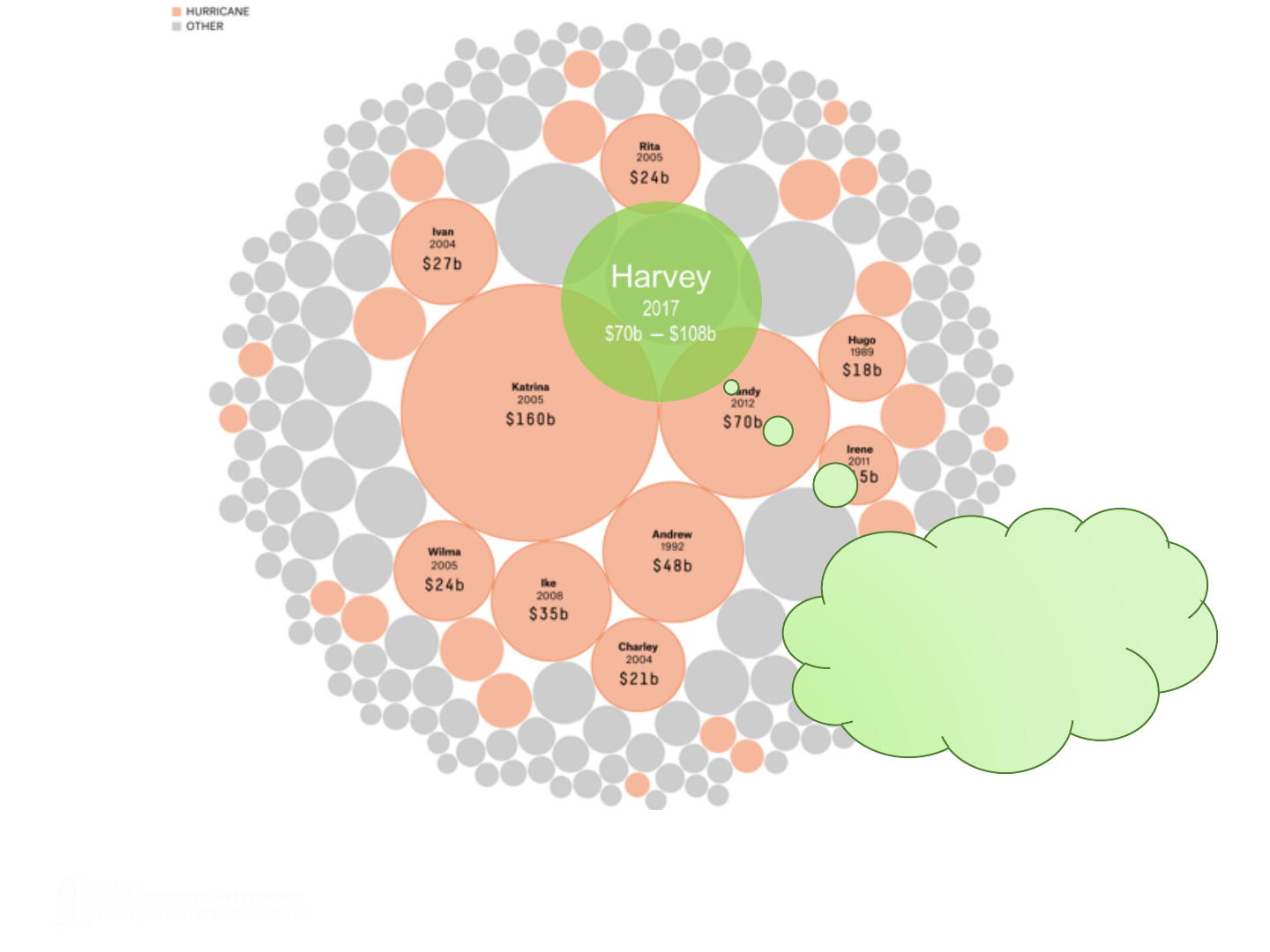

Harvey’s impact in Perspective

Latest expert estimates range from $70 billion to $108 billion

Discrepancies are

mostly due to

comparing apples

with oranges

3

Sources: NOAA, fivethirtyeight.com, and New York Times.

§ Casualties (economic losses due to deaths/injuries)

§ Property damages (insured and uninsured)

§ Infrastructure damages (industry and public facilities)

§ Temporary disruption to local business and economic

activity (evacuation, direct impacts)

§ Permanent loss of local businesses and residents

§ Increase in insurance cost (homes and businesses)

§ From the macroeconomic perspective, only lost output

(GDP, employment, earnings) counts!

Hurricane’s Costs

4

Most reported estimates cover only parts of the list …

Disaster Areas

TAMUCC UAS began surveillance 2 weeks after landfall …

Location: Holiday Beach community in Rockport, Texas.

5

§ About 80% structures damaged to different degrees from

winds and storm surge

§ Equivalent of 26% structures destroyed (uninhabitable) in

Port Aransas, and 43% across Aransas County

§ Statistically significant characteristics:

ü No meaningful difference between two communities, all else equal

ü Age of structure mattered

ü Tile roofs provided 10% more protection than shingle roofs

ü Standalone structures 15% more vulnerable

ü Waterfront properties 25% more vulnerable

ü Mobile homes sustained 20% more damage

ü Majority of roof damages were associated with N/NW winds

Property Damages

Statistical findings from a random sample of 600 properties in Port Aransas and Rockport …

6

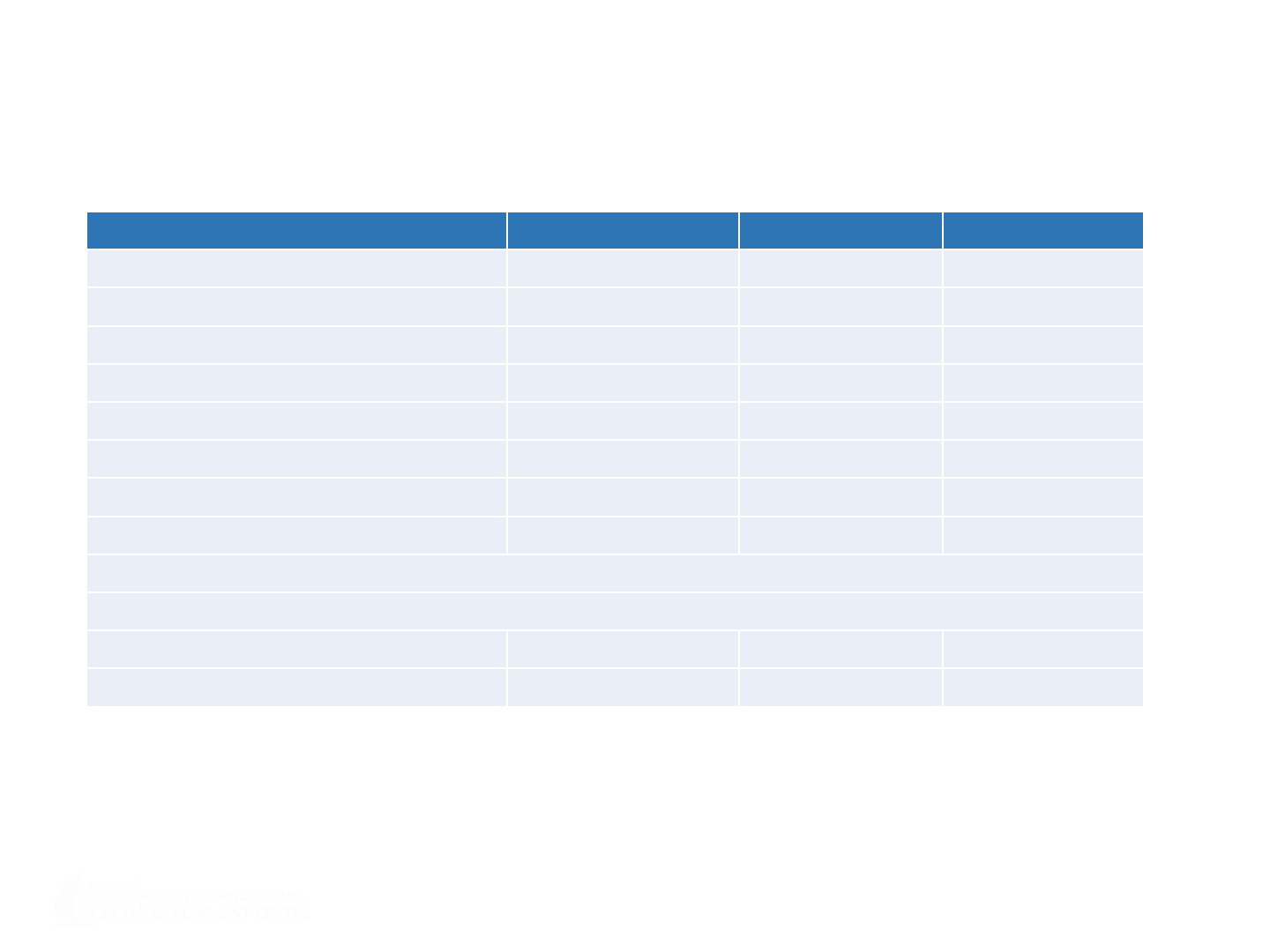

Community Profiles

Port Aransas Rockport Aransas County

Population (2016 Census) 4,054 10,645 25,721

Housing Units 4,289 6,290 15,614

- Detached Unit 2,341 3,993 10,145

- Attached Unit 1,716 1,470 1,979

- Mobile Home 232 746 3,288

- RV, boat, van 0 81 202

Annual Business Sales ($Mil) $361 $73 $885

Business Establishments 208 313 646

Property Damage from Harvey:

% Destroyed (equivalence) 26% 45% 43%

Total Home RCV ($Mil) $219 $557 $1,320

Sources: 2016 Census, EMSI, and South Texas Economic Development Center.

7

Baselines for impacted communities … reflecting vulnerability and capacity

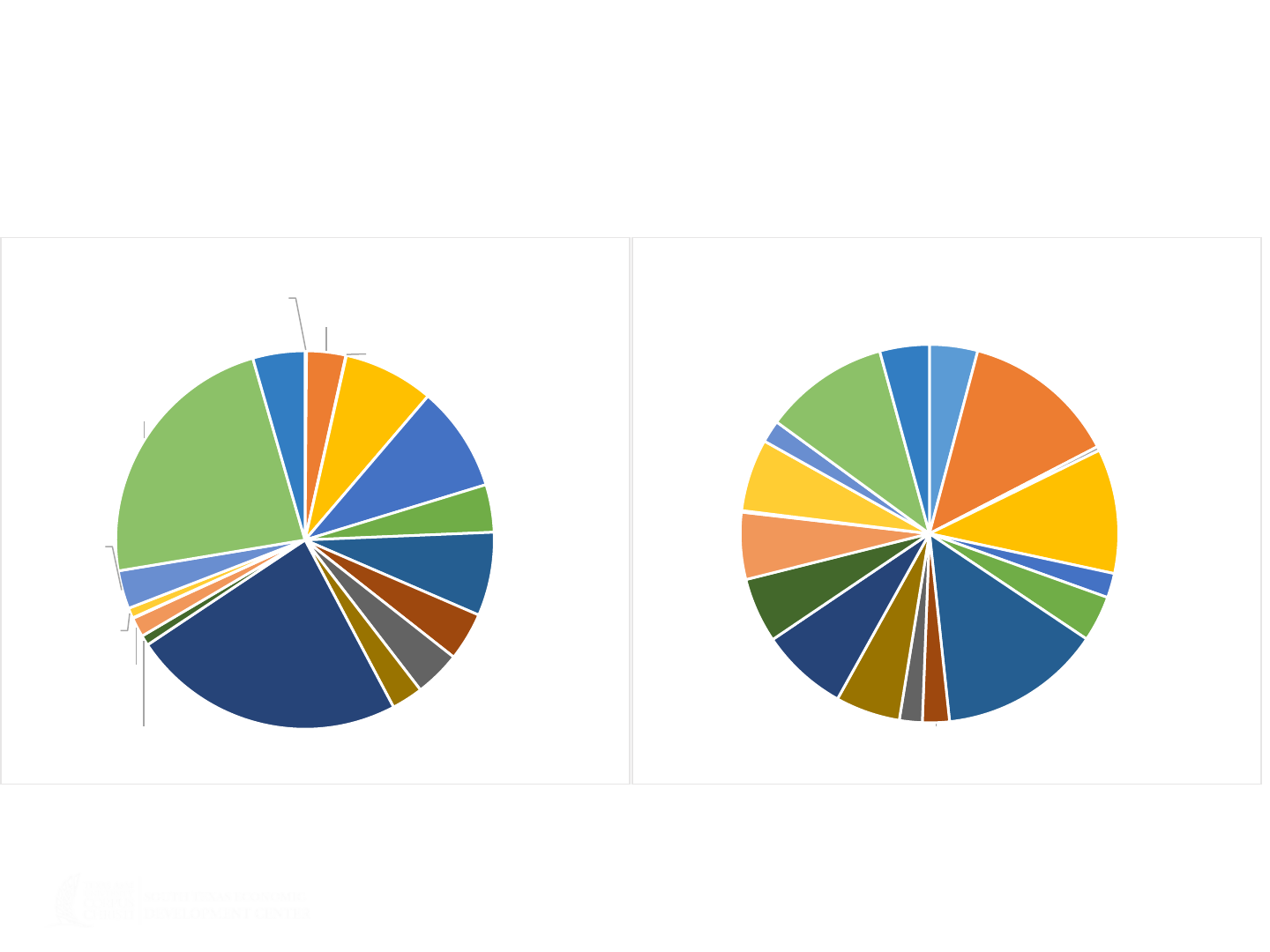

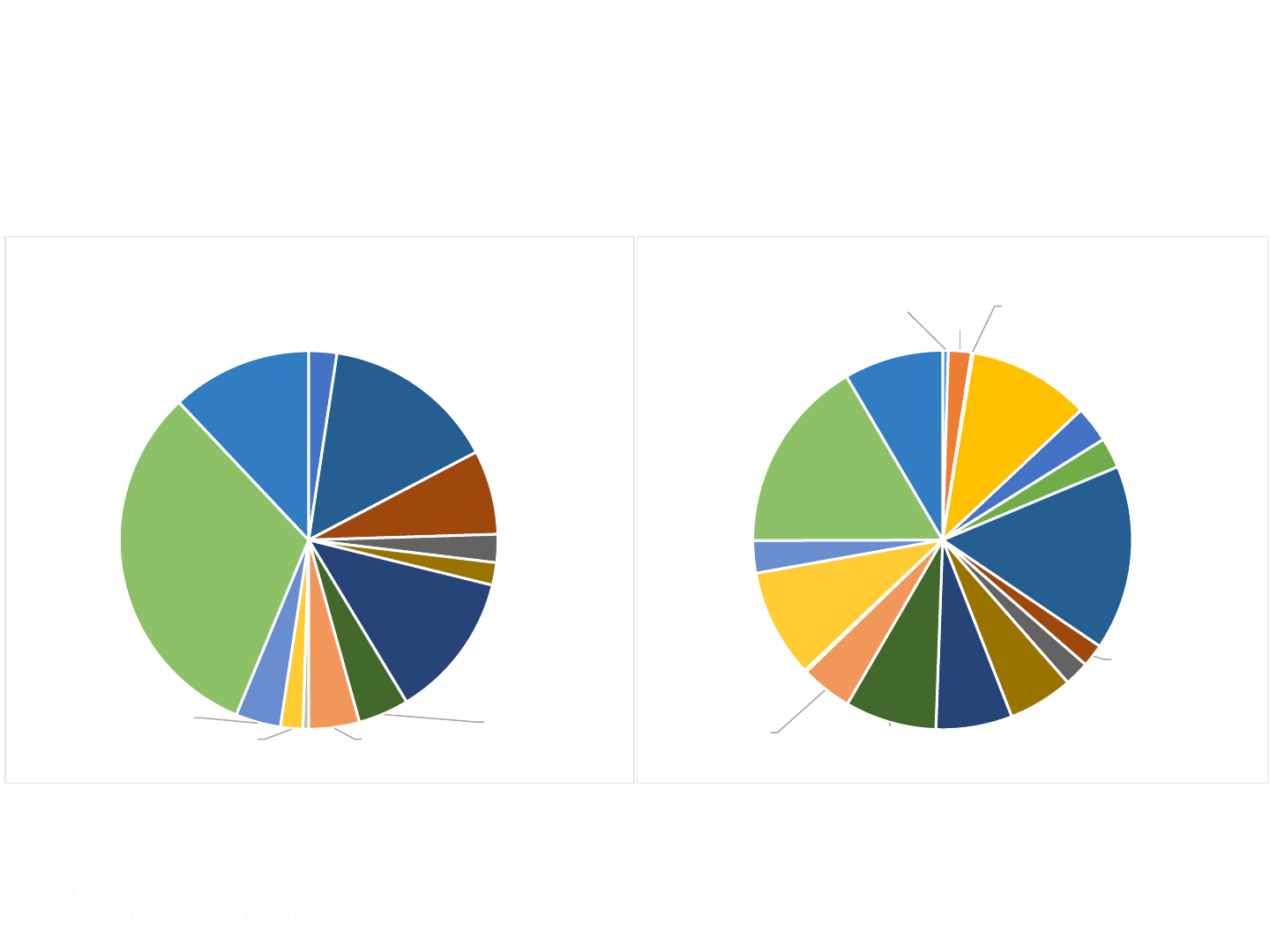

Pre-Harvey Economic Profiles by Size

Tourism and real estate together made up >50% of Port Aransas economy; retail and

hospitality were the largest sectors in Aransas County …

Source: EMSI, 2017.

Farming

$0.5

Mining, & Oil/Gas

Extraction

$12.1

Utilities

$0.2

Construction

$27.9

Manufacturing

$32.6

Wholesale Trade

$14.7

Retail Trade

$25.8

Transportation &

Warehousing

$14.9

Information

$14.2

Finance & Insurance

$9.7

Real Estate

$84.5

Professional &

Technical Services

$3.2

Administrative &

Waste Management

$6.0

Educational Services

$0.2

Health Care & Social

Assistance

$3.2

Arts & Recreation

$11.8

Accommodation &

Food Services

$83.7

Other Services

$16.1

Port Aransas Economy ($Mil Sales)

Farming

$36.4

Mining, & Oil/Gas

Extraction

$117.5

Utilities

$3.1

Construction

$94.3

Manufacturing

$18.5

Wholesale Trade

$34.8

Retail Trade

$123.0

Transportation &

Warehousing

$20.4

Information

$17.3

Finance & Insurance

$48.9

Real Estate

$66.1

Professional &

Technical Services

$49.2

Administrative &

Waste Management

$50.7

Educational Services

$1.2

Health Care & Social

Assistance

$54.7

Arts & Recreation

$16.9

Accommodation &

Food Services

$94.9

Other Services

$37.5

Aransas County Economy ($Mil Sales)

8

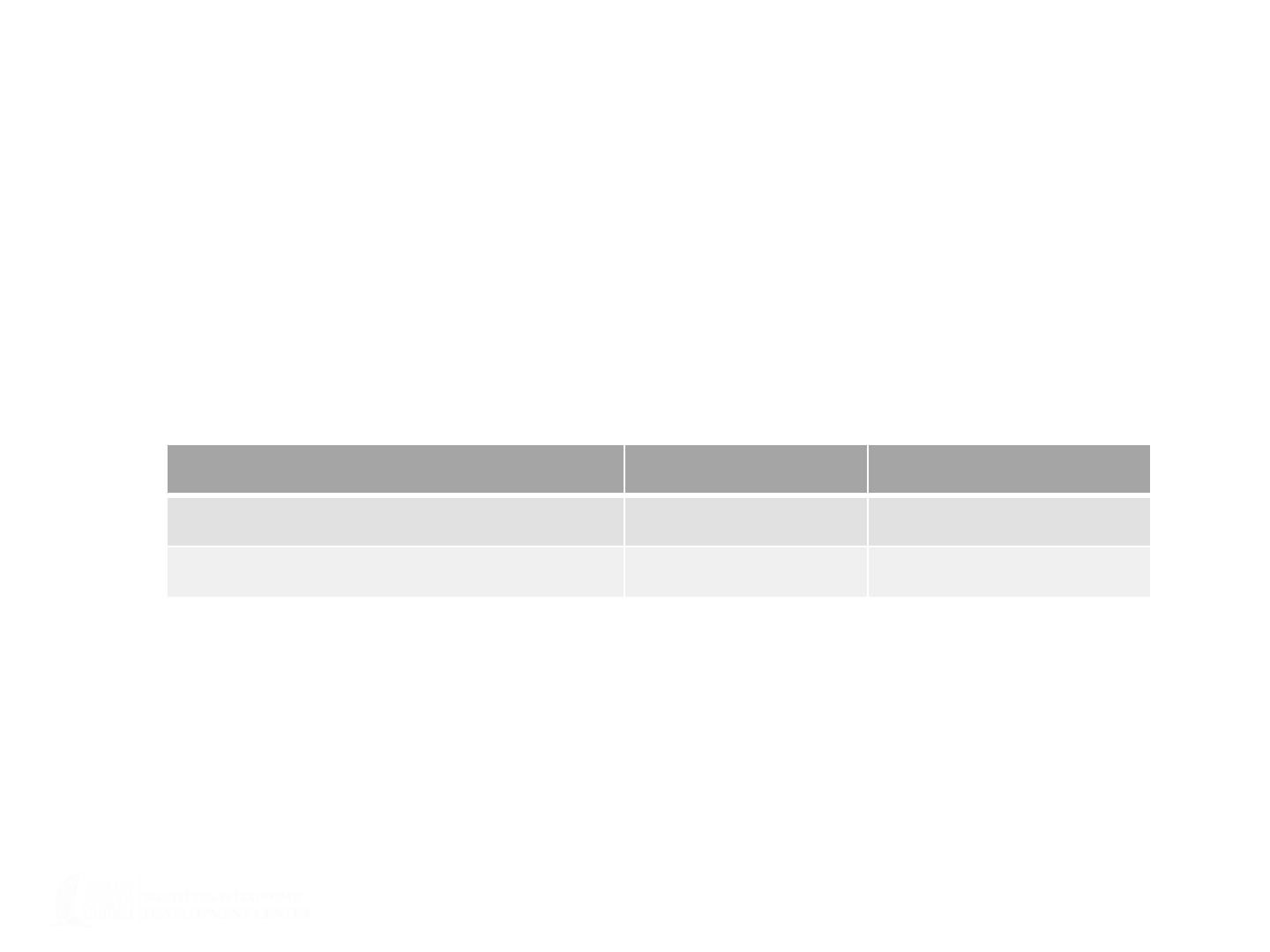

Pre-Harvey Economic Profiles by Number

Tourism and real estate together made up 55% of Port Aransas businesses; retail and

hospitality made up 31% of Aransas County businesses …

Source: EMSI, 2017.

Manufacturing

5

Retail Trade

31

Transportation &

Warehousing

15

Information

5

Finance & Insurance

4

Real Estate

26

Professional &

Technical Services

9

Administrative &

Waste Management

9

Educational Services

1

Health Care & Social

Assistance

4

Arts & Recreation

8

Accommodation &

Food Services

66

Other Services

25

Port Aransas Business Establishments

Farming

3

Mining, & Oil/Gas

Extraction

12

Utilities

1

Construction

64

Manufacturing

19

Wholesale Trade

16

Retail Trade

97

Transportation &

Warehousing

12

Information

13

Finance & Insurance

34

Real Estate

40

Professional &

Technical Services

48

Administrative &

Waste Management

27

Educational Services

1

Health Care & Social

Assistance

57

Arts & Recreation

17

Accommodation &

Food Services

102

Other Services

52

Aransas County Business Establishments

9

§ One week of business shut down in metro area

• $1.2B in gross sales activity, including wage earnings, etc.

§ Loss in capital stock

• Property damages in other areas are considered relatively modest

and scattered

• No direct impact on land

Harvey’s Immediate Impacts

Known knowns of immediate direct economic damage …

Port Aransas Aransas County

Residential $219M $1.3B

Nonresidential $12M $240M

10

§ Short- and long-term impacts on local

businesses and residents, including Winter

Texans

§ Increases in insurance costs for local businesses

and households

§ Recovery paths of impacted communities

Harvey’s Extended Impacts

Unknown knowns whose values to be realized … beyond direct damage

11

§ 3 Phases:

• Direct Impact (immediate): Loss of economic activity and capital

• Recovery (transitory): Rebuilding efforts take effect

• New Normal (equilibrium): Long-run occurs years later

§ Model Assumptions:

• All industries shut down when the area was hit

• Immediate loss of residential and nonresidential capital stock (values

correspond to observed damages)

• Separate capacity (resources) constraints for local and regional

economies

• Three alternative speeds in restoring businesses and residential and

nonresidential capital losses (100%; 25%; 10% per year)

§ Self-adjustment back to baseline occurs even without

government intervention, but “in the long run, we are all dead!”

Recovery Scenarios

Simulations of direct impact and response over time with a regional economic model

12

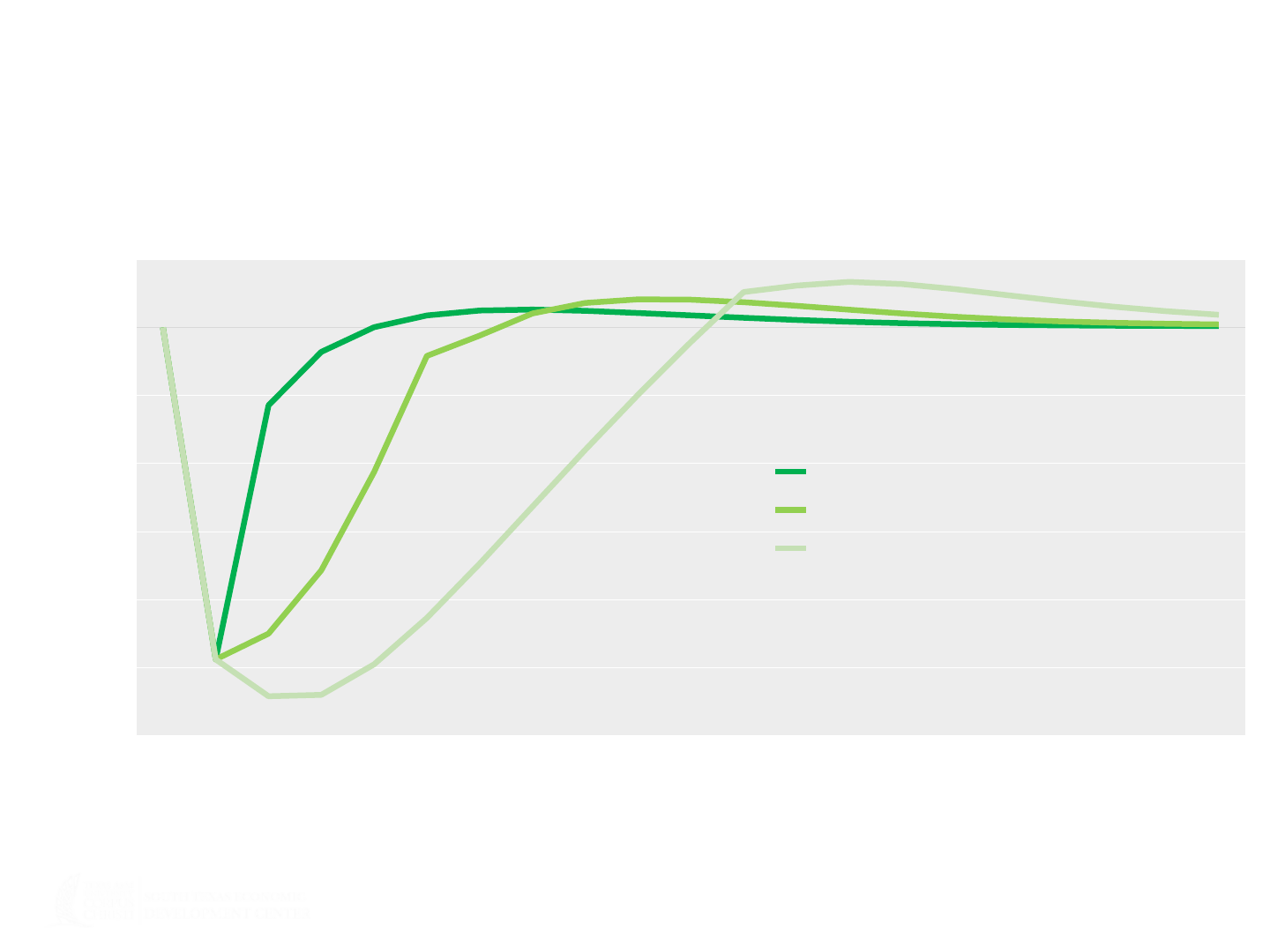

Road to Recovery

Slower rebuild efforts are more costly … cumulative output loss doubles with each delay

13

Source: South Texas Economic Development Center.

2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 2036

0

200

-200

-400

-600

-800

-1,000

-1,200

Port Aransas Output ($Mil Sales)

Immediate Recovery (1 year)

Rapid Recovery (4 years)

Slow Recovery (10 years)

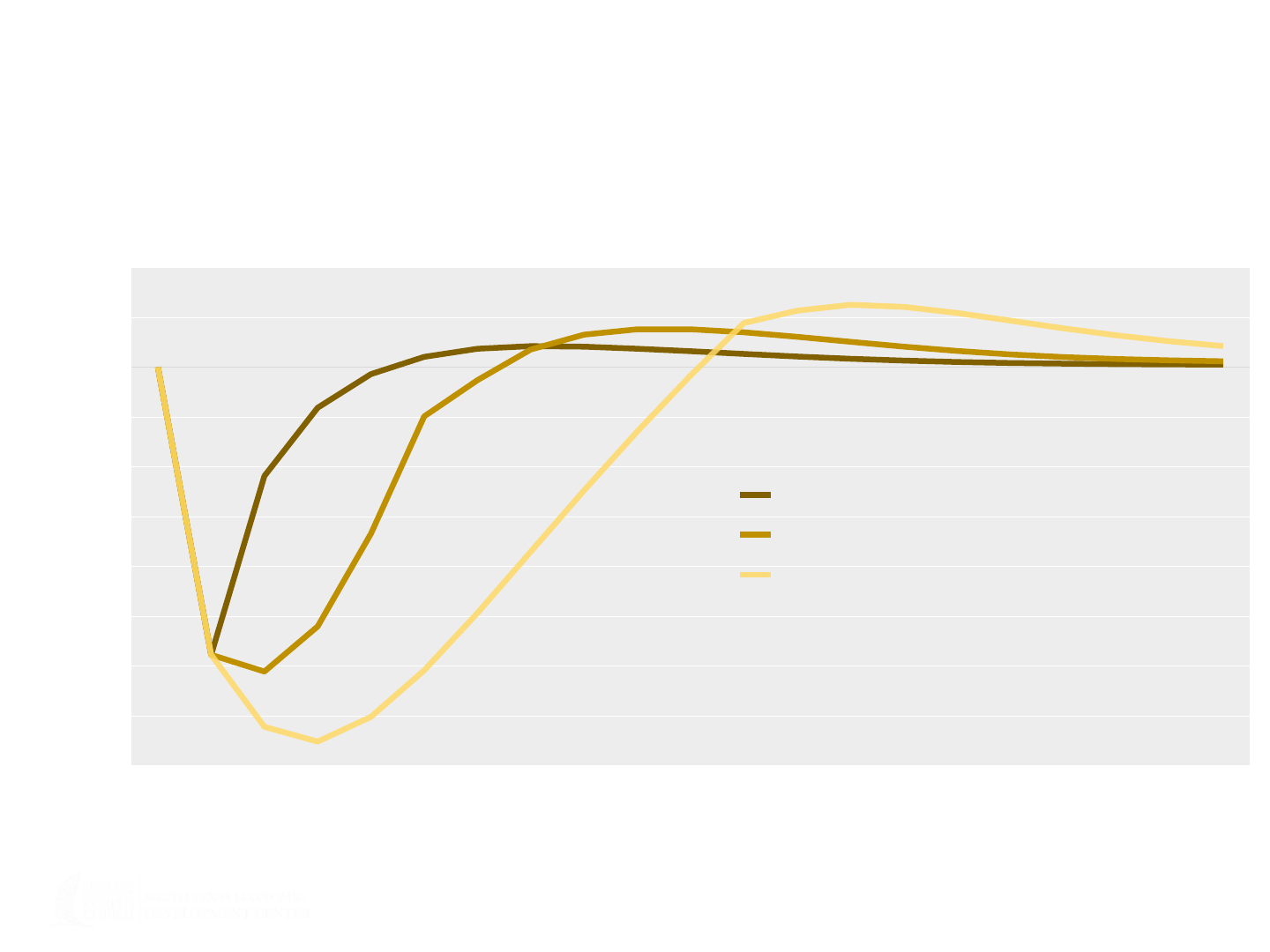

Road to Recovery

More rapid recovery is less painful … but challenged by available capacity

14

Source: South Texas Economic Development Center.

2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 2036

0

1,000

2,000

-1,000

-2,000

-3,000

-4,000

-5,000

-6,000

-7,000

-8,000

Aransas County Output ($Mil Sales)

Immediate Recovery (1 year)

Rapid Recovery (4 years)

Slow Recovery (10 years)

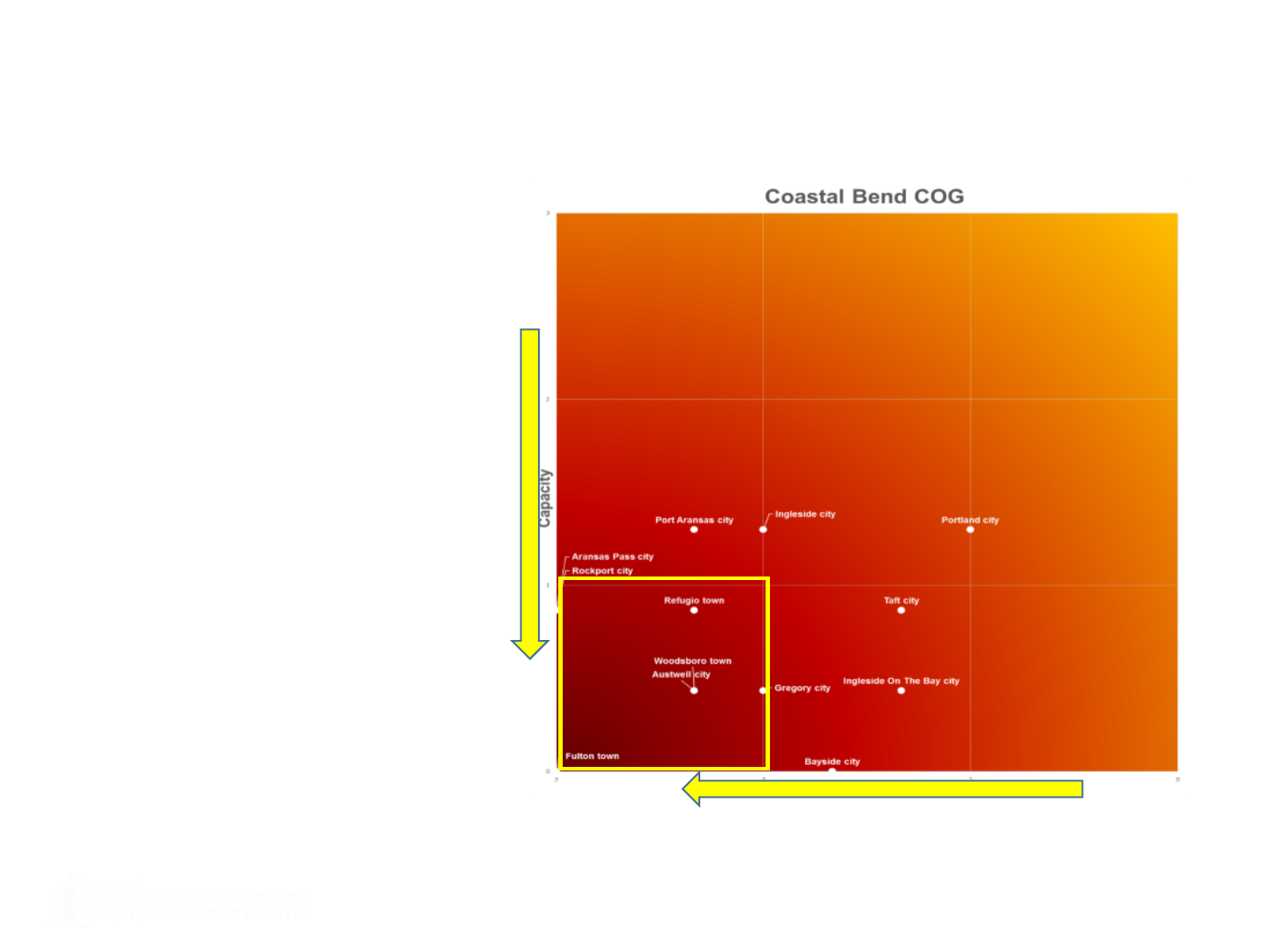

Communities with highest

impacts and lowest

estimated capacity:

• Aransas Pass

• Austwell

• Fulton

• Gregory

• Refugio

• Rockport

• Woodsboro

15

HIGHESTIMPACT

HIGHIMPACT

LOW

CAPACITY

HIGHCAPACITY

High Storm Impact, Low Capacity

Implication: More spillover economic impact on other parts of the Coastal Bend …

Source: Community Planning and Capacity Building RSF by Richard Martin, FEMA, October 5, 2017.

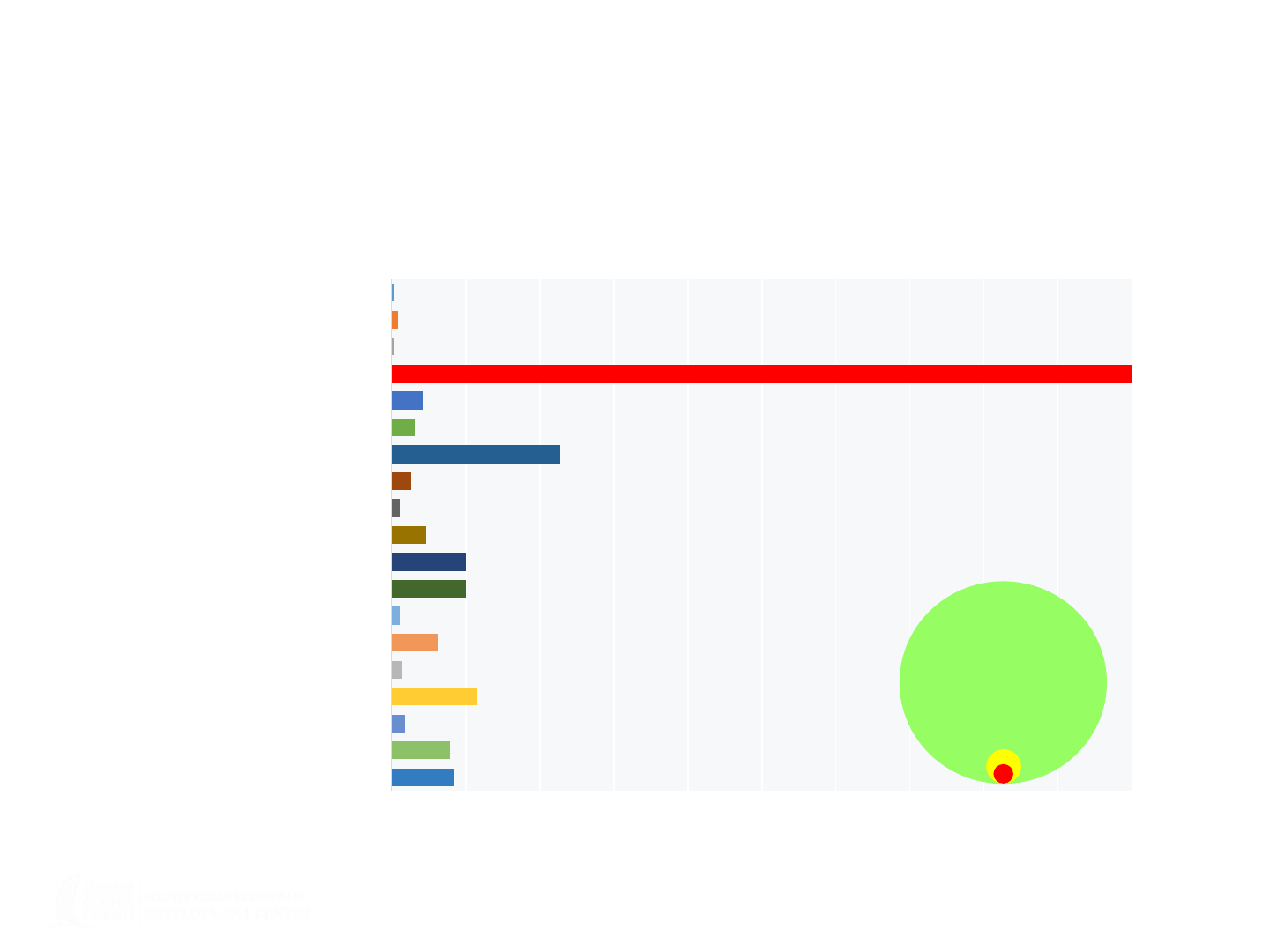

Indirect Impact on Region

Rebuild efforts boost regional construction and other industries …

Source: South Texas Economic Development Center.

10,0009,0008,0007,0006,0005,0004,0003,0002,0001,0000

Farming

Mining & Oil/Gas Extraction

Utilities

Construction

Manufacturing

Wholesale Trade

Retail Trade

Transportation & Warehousing

Information

Finance & Insurance

Real Estate

Professional & Technical Services

Management

Administrative & Waste Management

Educational Services

Health Care & Social Assistance

Arts & Recreation

Accommodation & Food Services

Other Services

Full Recovery’s Impact on Regional Employment (Job Years)

16,000

16

Corpus Christi MSA

Aransas County

Port Aransas

§ High economic impact from kick-starting businesses and restoring

capital infrastructure and properties sooner

§ But capacity matters: Reconstruction activity requires financial capital,

labor input and other resources

§ So it is not a community problem, but a regional solution

§ Possible to move above pre-disaster levels, especially with

federal/state support (rebuild vs. restoration)

§ Speedy recovery is vital for minimizing long-term economic losses

─ Resilience is the ability to “rebound economically from a disaster and to take

advantage of post-disaster market opportunity”… Jeffrey Sjostrom, 2012

§ No magic number: Reimagining the future of Coastal Bend

─ Tourism for coastal communities

─ New (more expensive) homes for displaced residents

─ Possible population loss in rural communities, particularly in Refugio

Takeaways

17

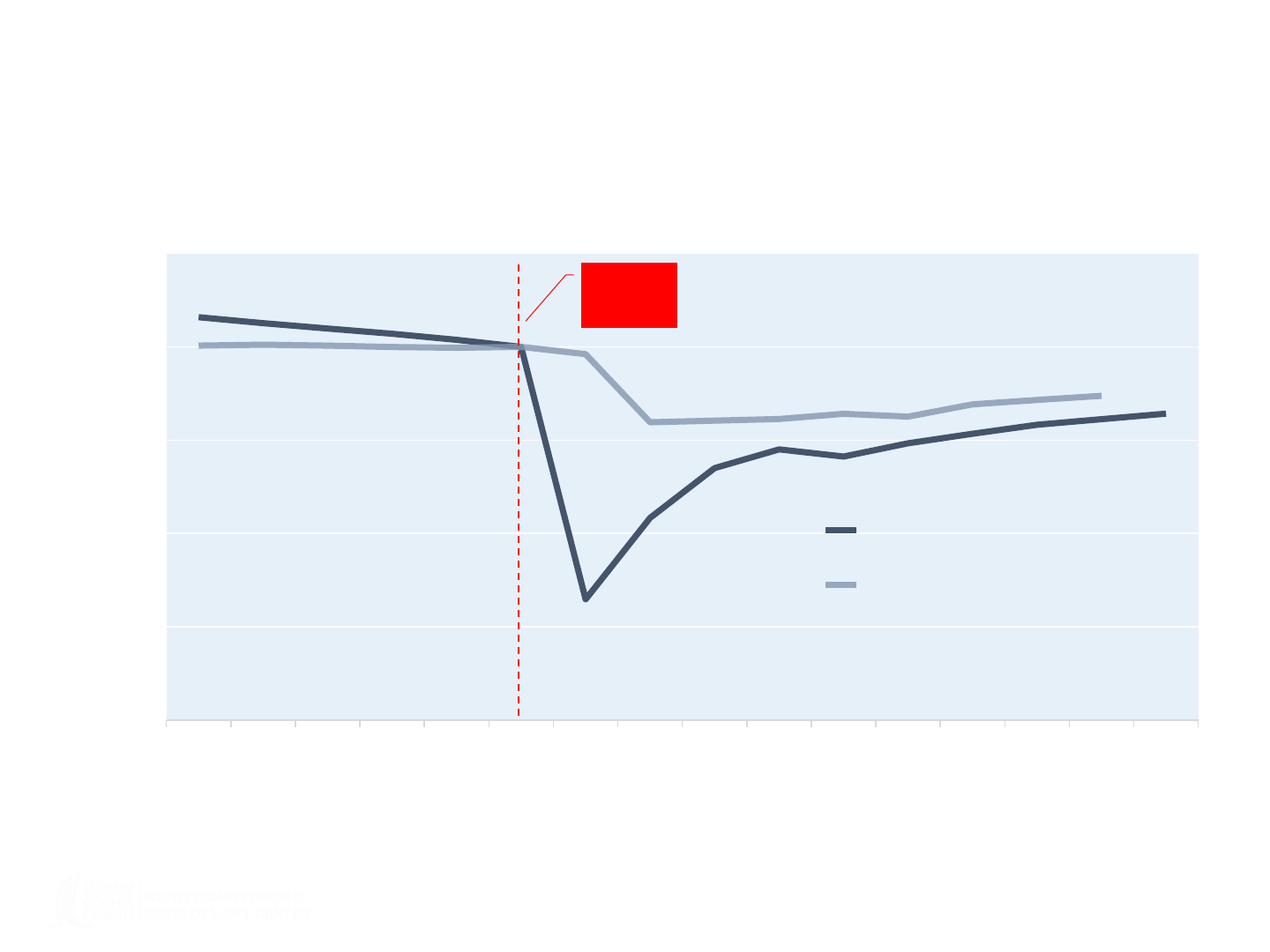

A Tale of Two Cities

What to learn from two recent storms and distinctive responses?

18

Year struck by Hurricane

-5 -4 -3 -2 -1 0 +1 +2 +3 +4 +5 +6 +7 +8 +9 +10

20

40

60

80

100

120

Population Trends (Base Year = 100)

New Orleans (Katrina 2005)

Galveston (Ike 2008)

Source: U.S. Census Bureau.

On

Impact

Jim Lee

(361) 825-5831

jlee@tamucc.edu

SouthTexasEconomy.com

Thank you!